As an employer, it is important you determine whether you are employing a contractor or employee for a designated job role. This is because the taxation, superannuation regulations and workers compensation entitlements are different for the two.

Read on to learn more about how their employment contracts differ or speak to one of Owen Hodge’s employment lawyers if you have any questions.

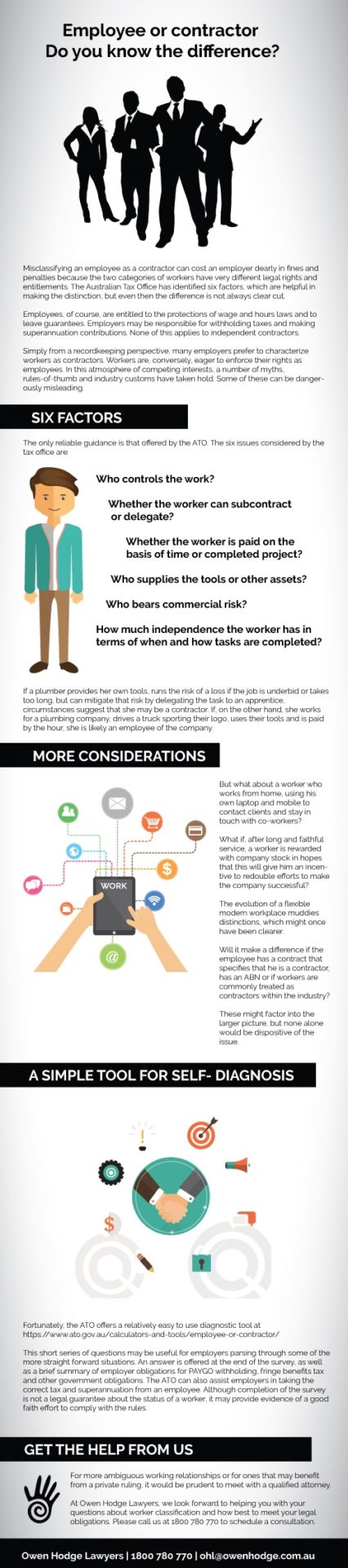

What is the difference between an employee and a contractor?

What are independent contractors?

Broadly speaking, workers are considered to be independent contractors when they:

- Determine their own scope of employment

- Have powers of delegation

- Are paid on performance basis

- Have a separate Australian Business Number (ABN)

- Are free to refuse and accept work.

What are employees?

Alternatively, if a person is considered to be an employee, he or she:

- Needs to be remunerated on a fixed basis by payment of salary or wages

- Has to be paid leave entitlements

- Has different tax and superannuation implications

So essentially, an employee works in your business and is a part of it, whereas a contractor is running their own business.

Why do companies hire contractors instead of employees?

There are a number of benefits to hiring contractors instead of employees, such as:

Contractors may cost less

Hiring a contractor may cost less than hiring an employee full-time. You may also be able to employ a contractor for a specific project that costs less than an employee doing it.

You can hire contractors on an as-needed basis

If your business has busy and slow periods, you can hire contractors as you need them. This saves employers from having to carry employees during slower periods.

You may need specific expertise or knowledge

Sometimes an employer may need a person for a specific project or task that an existing employee does not have the skills for. An example would be a business hiring a graphic designer for some advertising.

As an employer, you need to assess the requirements of your business in order to determine if you should hire a contractor or employee. If you need assistance with this, don’t hesitate to speak to the employment lawyers at Owen Hodge.

What to consider when employing contractors

Contractor employment contracts

Financially, an independent contractor is paid on performance basis or after the completion of certain assignment(s). Independent contractors pay their own tax and Goods and Services Tax (GST) to the Australian Taxation Office (ATO). They also generally have an ABN number and submit invoices for the work done.

They are paid at the end of the contract or project undertaken. You are not obligated to make any contribution towards the independent contractor’s superannuation.

Contractor rights and protections

The Independent Contractors Act 2006 (ICA), and the Fair Work Act 2009 (FWA) protect the workplace rights and entitlements of independent contractors.

The ICA was enacted to set up a national system for providing fair contractual rights and obligations for independent contractors. The ICA has replaced the local unfair contract laws in most states and territories including New South Wales (NSW).

If you are planning on employing an independent contractor, you need to keep in mind that:

- The terms of the contract should be fair

- Both parties have equal bargaining power

- Nobody can use fraudulent means or exercise undue influence on the other

- The payment made to the independent contractor is as per the market rates

The ICA provides serious penalties for contraventions of these provisions and any aggrieved party can request assistance from the Fair Work Ombudsman if there is any breach of employment contract.

Note: in NSW, the ICA overrides the deeming provisions of New South Wales Industrial Relations Act 1996 (NSW IR Act) which regards independent contractors as employees if they are engaged in various building and construction trades, including: carpenters, joiners, bricklayers, painters, timber suppliers, plumbers, drainers, plasterers, blinds fitters, ready mixed concrete drivers or RTA lorry drivers. See also: public sector employees

If you’re a contractor, beware of sham contracting arrangements

While entering into an independent contracting arrangement, you should be careful regarding sham contracting arrangements. An employer may try to disguise an employment relationship as an independent contracting arrangement to avoid responsibility for employee entitlements.

The Fair Work Act prohibits an employer from:

- Illegally representing an employment contract as an independent contracting arrangement

- Dismissing or threatening to dismiss employees for the purpose of engaging them as an independent contractor

- Fraudulently inducing a person to become an independent contractor

The Fair Work Act provides serious penalties in case of any such act. If you find yourself in a situation where it is unclear whether you are a contractor or employee, don’t hesitate to get in touch with Owen Hodge’s experienced lawyers.

Learn more:

So, contractor or employee?

The thin line between deciding a contractor or employee contracting agreement is often blurred. But the team of experts at Owen Hodge Lawyers can guide you in this regard. If you have any questions about contractor law, subcontractor rights in Australia or whether you should hire a contractor or employee, contact us today. We can help you decide upon and document an arrangement to perfectly suit your business needs.

Learn more: Do I Have the Same Rights As an Employee If I’m Employed As a Contractor?

Employment Law Team

Frequently asked questions

As a contractor, you often forfeit the typical entitlements that regular employees have. Such as:

- Contractors do not enjoy superannuation benefits, unlike employees, except in a few cases.

- Contractors are not entitled to annual, sick, long, personal carers, or extended leave.

No, a contractor is not a casual employee. A contractor works for their own business, whereas a casual employee is employed at a business.

It ultimately depends on your situation and circumstances. Contractors do enjoy a number of benefits, such as:

- You are your own boss

- Flexibility in working hours and who you work with

- You may be able to earn more as you can set your own rates

However, there are also some drawbacks, which include:

- You don’t receive the same benefits as employees (personal leave, sick leave, superannuation benefits etc.)

- Responsible for own tax and superannuation