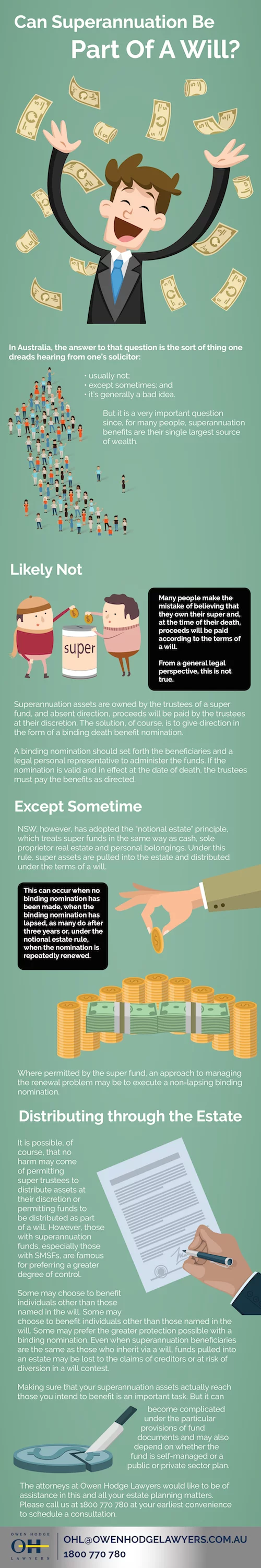

Many people make the mistake of believing that they own their superannuation and, at the time of their death, proceeds will be paid according to the terms of a will. From a general legal perspective, this is not true. Superannuation assets are owned by the trustees of a superannuation fund, and absent direction, proceeds will be paid by the trustees at their discretion. The solution, of course, is to give direction in the form of a binding death benefit nomination.

T he state of NSW however, has adopted the “notional estate” principle, which treats super funds in the same way as cash, sole proprietor real estate and personal belongings. Under this rule, super assets can be pulled into the estate and distributed under the terms of a will. Read the below infographic for more information on combining your super with your will.

If you have any legal questions regarding your will or super assets, please do not hesitate to contact Owen Hodge Lawyers on 1800 770 780.

How To Include Your Superannuation Into Your Will

Get in touch: 1800 770 780